New Driver’s License Rules for Visa Holders in the United States: Maximum One-Year Validity

A new and controversial measure has come into effect in the State of Florida, significantly impacting the daily lives of temporary visa holders: the new

A new and controversial measure has come into effect in the State of Florida, significantly impacting the daily lives of temporary visa holders: the new

A new mechanism is taking shape in the United States aimed at facilitating the arrival of international fans for the FIFA 2026 World Cup: the

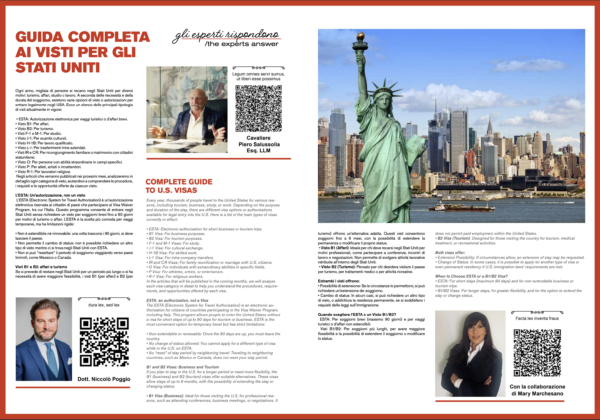

Every year, thousands of people travel to the United States for different reasons: tourism, business, study or work. Depending on the needs and length of stay, there are several options for visas or permits to legally enter the United States. The full article is available at the following link:

https://www.gatemag.it/rivista_44.asp

Following a December 23, 2024 decision by the U.S. Court of Appeals, most reporting companies must once again comply with beneficial ownership reporting requirements to FinCEN under the Corporate Transparency Act (CTA). To allow companies time to adjust after a recent preliminary injunction, the Department of the Treasury has extended deadlines

On December 26, 2024, a panel of the U.S. Court of Appeals for the Fifth Circuit issued a pivotal decision in Texas Top Cop Shop, Inc. v. Garland, vacating an earlier order from the same court that had temporarily allowed the enforcement of the Corporate Transparency Act (CTA). This latest ruling reinstates the preliminary injunction issued by the U.S. District Court for the Eastern District of Texas, effectively halting the requirement for reporting companies to file beneficial ownership information with the Financial Crimes Enforcement Network (FinCEN).

How to Save on Your Expat Taxes: Reduce or Eliminate US Taxes with the Foreign Earned Income Exclusion (FEIE)

For U.S. citizens and permanent residents living abroad, navigating the U.S. tax system can be a daunting task. Unlike many countries that tax individuals based only on their residency or the source of their income, the United States taxes its citizens and residents on their worldwide income, no matter where they live or earn it. This can create a challenging situation for expatriates, as they may find themselves facing taxation in both the U.S. and their host country.

https://youtu.be/Z7agWmHA0m0 Albert Wastson is a Scottish fashion, celebrity, and fine art photographer and has been acclaimed as one of the 20 most influential Artist of

With the presidential proclamation of January 25, 2021, US President Joe Biden reconfirmed the restrictions on entry to the United States for travelers from Schengen Area countries. In light of current legislation, the possibility of entry into the United States is…

Quando si tratta di costituire una società negli Stati Uniti (“US”) sono molte le domande che sorgono in merito alla scelta da effettuare;

Do not hesitate to contact us and one of our consultants will get back to you.