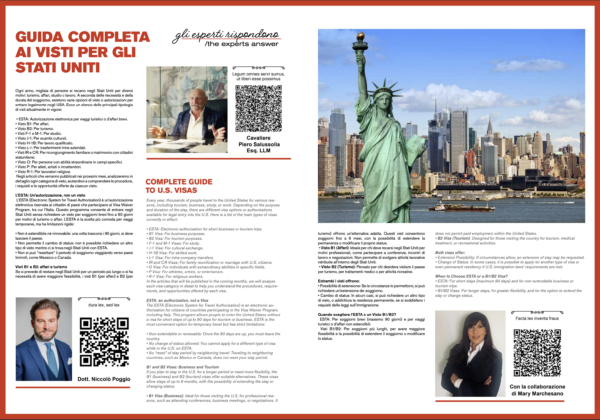

COMPLETE GUIDE TO VISAS FOR THE UNITED STATES.

Every year, thousands of people travel to the United States for different reasons: tourism, business, study or work. Depending on the needs and length of stay, there are several options for visas or permits to legally enter the United States. The full article is available at the following link:

https://www.gatemag.it/rivista_44.asp